Digi@Bank monitor

How, at what pace and in what steps will the Hungarian banking customer become digital? What proportion of people bank from mobile or computer? To what extent are they moving their finances out of the world of traditional, universal banks and towards fintech providers? What do you think about new channels such as chatbots or video banking? Which banks' internet banks and mobile banks do customers like the most? How has this changed in recent times? Do customers still call the call centre at all? Why? How many internet users visit a bank branch? What are the branch experiences? Do we want to open an online account now? What do we think about online credit card payments? What is the digital image of each bank?

Are you concerned about these and similar issues?

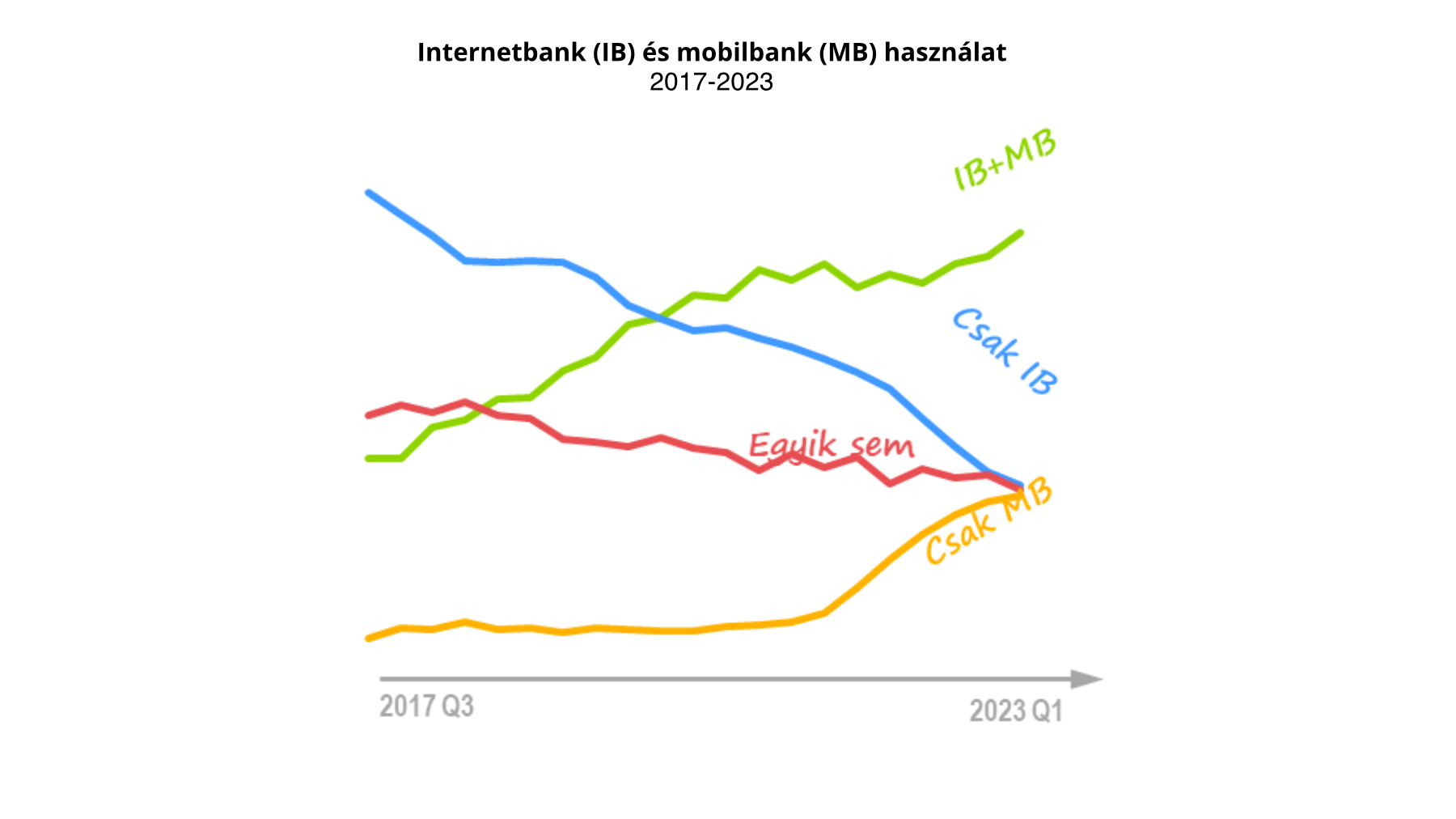

Trends in the use of digital channels will continue in the second quarter of 2023. According to internet banking penetration continues to fall, currently 60% enters with some frequency. Although we do not see an increase in mobile banking usage compared to the beginning of the year (65% using it), the cross-usage rates clearly show that mobile app now beats internet banking in every respect (both in terms of the proportion of users, frequency of use and preference)."

About the research:

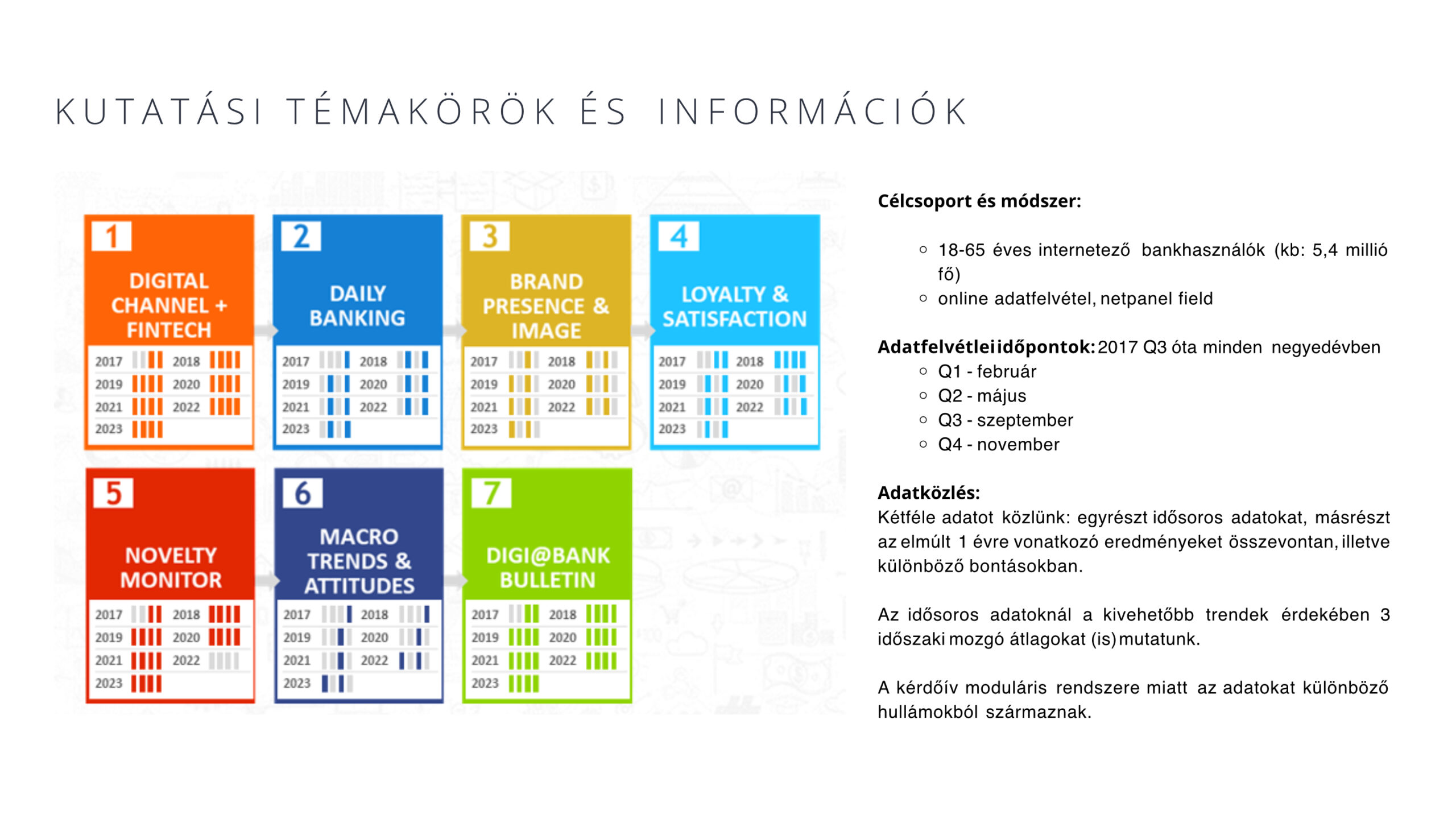

- 1000 people are interviewed every quarter

- Bank users aged 18-65 complete the questionnaire

- in addition to the usual representativeness of gender, age group, education, municipality and region, we also ensure that our sample follows the correct proportions in terms of banking and smartphone usage, which is why we measure these on our omnibus on a continuous basis, and thus have an accurate representative sample of 18-65 year old internet banking users on a quarterly basis

- measured four times a year, at the beginning of the year in predetermined months

- the questionnaire is modular, i.e. not all topics are asked every quarter

- the analysis is a quarterly document of around 100 pages, containing the most recent data from each theme, i.e. a complete picture of the Digi@Bank themes, whether from the current or previous measurement

Digi@Bank Monitor subscription

The Digi@Bank Monitor is an annual subscription service, with a usage contract with our customers, valid for four waves of the calendar year. The subscription also includes the Digi@Bank Bulletin, which is an ad hoc block of information for our customers, updated each quarter. We have previously researched issues such as instant payments, the MKB-BB merger, or topical issues such as what customers think about the change from SMS to push notifications. We are looking for suggestions from subscribers on the issues we are currently investigating. In addition, for an additional fee, we can also ask exclusive questions, which are not sent to other subscribers.

Download free report

More articles

Inflációs várakozások 2024-re és az áremelkedések fogadtatása

Az ügyfél-elégedettség mérés fontossága és mérőszámai

Piackutató

Az e-kereskedelem trendjei – 2024

A piackutatás 2024-es trendjei

NRC piackutatás: e-kereskedelem, mobilbankhasználat 2023

AI forradalom a piackutatásban: új kihívások és lehetőségek

Most jöttem a KSH-ból: a minőségi piackutatás

Az omnibusz szerepe és előnye a piackutatásban

AI és lakosság – mi történt a nyáron?

Ügyfélélmény: bevált receptek a profitnöveléshez

Is age just a number?

Downloadable infographics